Access to credit has remained an unsolved financial inclusion issue for decades. Most small to medium-sized companies suffer from having no access to credit. But the situation is even more problematic in financial services. Especially money service businesses are left out, because they are considered risky with money laundering and terrorist financing concerns.

While businesses try to survive in harsh competition, having no access to funds ultimately hinders their expansion and growth. It causes monopolization in the business world and creates underserved crowds.

This is one of the main problems of traditional finance that crypto lending successfully addresses. It enables people and businesses that need money to easily get their hands on funds and scale.

With the unique benefits it provides, such as 24/7 availability, cross-chain liquidity, favorable pricing and repayment options, and convenience, the crypto-backed lending space has taken off over the past few years.

Of course, banks have been dominating this field for decades, and they are still the biggest providers of credit. But crypto lending is rapidly catching up with its much-needed offers. The short answer to the title is: yes, they are threatening banking’s top revenue stream. But how, and to what extent?

Understanding Net Interest Margin

Today, any business looking to get a loan will most likely want to get a bank that can finance them. In return for this financial commitment, banks get interest on their loans. And that interest plays a significant role in boosting the bank's profitability.

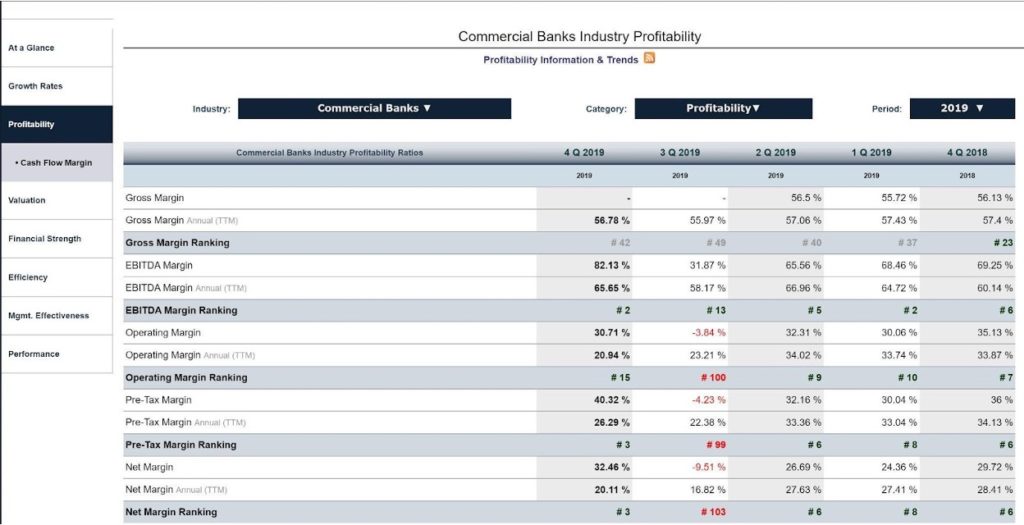

In accounting terms, one of the most reliable metrics to show bank profitability is the net interest margin. This metric essentially measures the difference between the interest earned on loans and the interest that banks give out on customer deposits.

So, imagine a bank gives out $100 billion in loans in a year and earns $5.5 billion in interest. If the bank also paid out $1 billion to depositors in interest, its net interest margin becomes

$5.5 billion - $1 billion) / $100 billion = 0.045, or 4.5%

Net income margin has always been a major source of income for banks. Data from CSI Market shows that as of 2020, the trailing 12-month net profit margin for retail and commercial banks stood at 13.9%. If you think this is high, then consider that the metrics for the three prior years were 23.8%, 24.3%, and 27.9%, respectively.

2020's figures were only small because of the impacts of COVID-19. With the pandemic already easing and life almost fully back to normal, the number is expected to rise.

It is evident that loans are critical to the success of any bank. With the rise of crypto lending right now, banks appear to have a significant threat to a major stream of revenue that could come their way.

Fractional Reserve Banking: Powering the Global Lending System

One of the many factors that have led to the proliferation of traditional lending is fractional reserve banking. This is a system in which only a portion of a bank's deposits are backed by actual cash and are available for customer withdrawals. The rest is given as loans, allowing banks to expand and infuse capital into economies.

Say you deposit $100 in a bank. Thanks to fractional reserve lending, the bank can essentially set aside $10 to cover your deposit and possible withdrawals, and lend out the remaining $90 as loans. But when you -the depositor- check your balance with the bank, you still see your $100. So, just before lending, the bank has a total of $190 in the books. The bank has essentially created $90 out of thin air, which it will issue as loans to make more interest going forward.

Given that the chances of you withdrawing your entire balance from the bank are low, your funds eventually go towards making money for the banks. Now, imagine that big banks do this with the billions of dollars they have in customer deposits.

Fractional reserve banking is an accounting trick only available to corporations that have a proper banking license. Non-bank financial institutions (NBFIs) don't have that privilege. Ever wondered how big banks make billions from interest on loans? It all goes back to this system.

Crypto-Backed Lending: A Significant Threat To Banks

The world is going through a seismic financial change right now. Cryptocurrencies have become incredibly popular, and so has the prospect of getting loans through digital assets.

Especially after the pandemic, traditional financial institutions were overwhelmed with the requests from individuals and businesses for loans, and they could barely pick up. Cryptocurrencies eventually came to the rescue, offering loans to many businesses that would essentially have been bankrupt without them.

Crypto loans were a huge boost, especially for decentralized finance (DeFi). As more loans were being dished out, lending protocols were the stars of the DeFi space. Now, we have yield farming protocols, decentralized exchanges, and more platforms populating DeFi - all the way to over $80 billion in total volume locked.

So, why is crypto-backed lending a big threat to bank’s revenues?

Global reach

For all the growth it has achieved, traditional lending is still highly limited. Only developed countries can access the most seamless lending services, and even many businesses in the most remote areas of these countries can be left out.

Crypto-backed loans overcome this issue by expanding their reach. As long as you've got good internet, you can log on to a crypto lending platform and get the funds needed for your business. Crypto-backed loans don't need so much infrastructure, and this makes for a very streamlined lending process.

No credit checks

Speed is another area where crypto-backed loans appear to have the upper hand. With traditional loans, you have to go through one step after the other to get a loan for your business. The bank will have to verify that you're creditworthy, examine the parameters of your business, and perform other checks to ensure that their money is in safe hands. When the process is done, you could still be rejected!

With crypto, the entire process is cut. There are no credit checks, and you don't need to bring anyone to stand in for you. All you need to do is provide crypto as collateral, and your funds will be released to you. For businesses that need money urgently, crypto loans are more than ideal.

Growth for emerging economies

Another huge benefit of crypto-backed loans is that they are ideal for countries where financial inclusion and infrastructural development are still low. Many developed countries have the same loan needs as their developed counterparts. When businesses in these countries cannot get the loans they need, the economies can't grow.

Fortunately, crypto loans take care of this problem easily. There are no credit checks, so businesses in countries without proper credit systems can still access proper loans and much-needed cash. Crypto loans are also run exclusively on the internet - you don't need to stand in line, fill out paperwork, or go through any of these bureaucratic steps. Just sign up, present your collateral if needed, and access your loans.

It’s a matter of when, not if.

Cryptocurrencies have ushered in what many believe to be the greatest era of wealth redistribution in a generation. But, it is worth noting that the industry remains nascent. As it grows, there is no doubt that crypto-backed lending will surge along with it.

While banks continue to rule the lending space, crypto-backed lending platforms are hot on their trails. They offer speed and convenience, and their nimble characteristic makes them perfect for businesses in developing countries that need quick access to capital for expansion.

Right now, it’s a matter of when crypto-backed lending will become the industry standard; not if.