Cryptocurrencies have grown in popularity over the past few years. One of the reasons for this is their increased utility for financial transactions. Today, cryptocurrencies are used for investments and payments, and their compatibility with other financial transactions makes them the perfect innovation for today’s complex business landscape.

Interestingly, one of the areas where digital assets have thrived the most has been lending. Whether centralized or decentralized, crypto lending has really taken off. Today, there are several crypto lending platforms that offer crypto-backed loans at different rates and loan terms.

These lending platforms have become especially popular over the past two years, thanks to the impact of the coronavirus. However, even with the global pandemic’s effects on the markets slowly reducing, crypto-backed lending has remained a behemoth sub-industry. So, can this trend last?

Understanding Crypto-Backed Lending

Crypto lending works pretty much the same as traditional lending - someone commits cryptocurrencies to a protocol, and they earn returns based on their coins being given out as loans.

With crypto lending, there are usually three parties involved - the lender, the borrower, and the third party. Lenders give their cryptocurrencies to a third party, which disseminates the funds to borrowers looking to access easy loans. Anyone can be a lender, and anyone can be a borrower. As long as you can fulfill your obligations, you’re in.

The typical crypto lending process goes like this:

- Lenders go to a lending platform (the third party) to deposit funds and provide capital

- A borrower looking for money goes to a lending platform

- The borrower stakes their cryptocurrency as collateral to get loans. They agree to forfeit control of their collateral until they can pay back the loan.

- When the loan is repaid, the lending platform gives back control of the borrower’s collateral and distributes the interest to the lenders.

There is also lending in the decentralized finance (DeFi) space. DeFi lending is unique because it is a slightly faster process than centralized lending. Here, the entire lending process is handled by smart contracts, which take liquidity from lenders and distribute them to the borrowers. When the loans are repaid, the lenders get their interest.

DeFi lending platforms like Aave and Curve Finance can also issue their tokens to lenders (otherwise known as “liquidity providers’) in exchange for their funds. These tokens have value on their own, and they offer an additional opportunity for investors to make money.

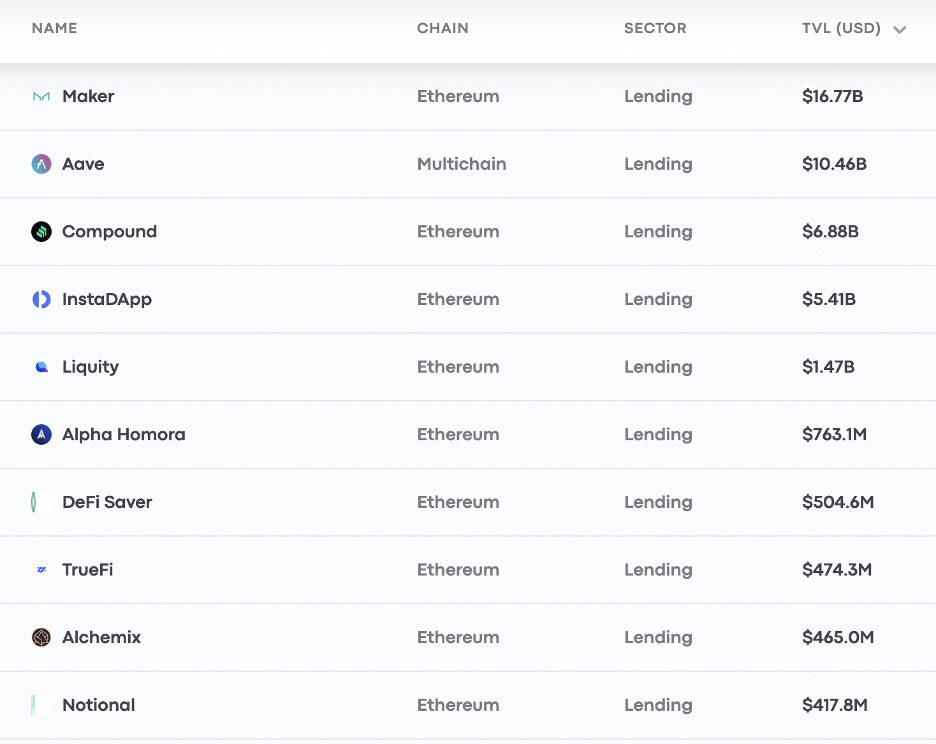

So far, DeFi lending has really taken off. Data from DeFi pulse shows that the entire DeFi industry has $78 billion in assets locked. Of that amount, the top 5 lending protocols alone account for $39.85 billion in assets.

The Rationale for Credit

Primarily, the suppliers of credit for crypto lending are both individual and institutional investors. Crypto lending platforms have done a good job so far of democratizing access to the market, meaning that anyone with enough money can be a lender.

Then, there are big institutional investors and hedge funds. A report from PwC in 2020 showed that 38% of all hedge funds invested in the crypto market had backed crypto lending platforms. The reason for this appears to be the growth in the crypto lending space and the expansion of platforms to other functions.

As the auditing firm explained, many exchanges and lending platforms have been able to expand to offer advanced trading features as well to their customers. In addition to the increased popularity of loans and interest rate arbitrage, these hedge funds and institutional investors now have more avenues to make money from the crypto market.

The report added:

“These developments are also enabling funds to take short positions more easily as the derivatives market has become more diverse and more liquid. This means that crypto funds are more easily able to offer complex investment strategies such as market-neutral, as they have a more advanced toolkit at their disposal.”

2020 Crypto Hedge Fund Report

Of course, there is also the fact that many of these institutional investors take positions in cryptocurrencies themselves and would like to see their money work for them. So, they simply lend out these funds as loans and get even more interest over time. So, as a passive investment strategy with little to no downside, crypto loans make sense for risk-averse institutions.

But Are Crypto Loans Completely Risk-Free?

As with every investment strategy, the answer to this is no. Crypto loans are seen as more beneficial than traditional loans, and the truth is that they are. These loans are more flexible, quicker, and generally more favorable for both parties.

But, there are inherent risks to crypto loans. First is the fact that these loans generally don’t need credit checks. In order to make for a more flexible environment, most crypto lending platforms don’t perform credit checks on borrowers. This opens the door for some fraudulent borrowers to game the system.

Then, there is the inherent risk of the market itself. The market’s unsteady nature can easily lead to a margin call, where borrowers are forced to commit more funds to maintain the value of their initial commitment.

Last but not least, there is still regulatory uncertainty around the world where regulators are not sure about how to classify DeFi lending. The $100M penalty BlockFi received from the SEC in the United States is one of the latest examples of the consequences of such uncertainty.

That being said, there are a lot of benefits that companies can get from crypto loans nonetheless. We currently live in a world where traditional financial institutions are dealing with growing requests for loans. These financial institutions themselves haven’t been particularly effective in giving out loans in the first place, and many prospective borrowers want an alternative.

This is why crypto-backed loans are the next big thing. They are easier to get, more flexible, and better to navigate. With more products entering the space and offering easy access to credit, crypto-baked loans are expected to be here for a very long time.