Within just a few years, USDC demonstrated its utility as a revolutionary tool for facilitating borderless payments. Its stability, as a result of being pegged to the value of the US dollar, has proven to be a compelling advantage, enabling it to be used in a variety of real-world use cases such as cross-border transactions and remittances.

The cross-border payments industry reached $156 trillion1 in 2022 and is expected to grow at a 5% annual pace. In the meantime, stablecoins have started to be increasingly used for cross-border transactions as a fast and cost-effective means of payment. As of late January 2023, the total capitalization of stablecoins reached $138 billion2, executing $7.4 trillion worth of transactions.3

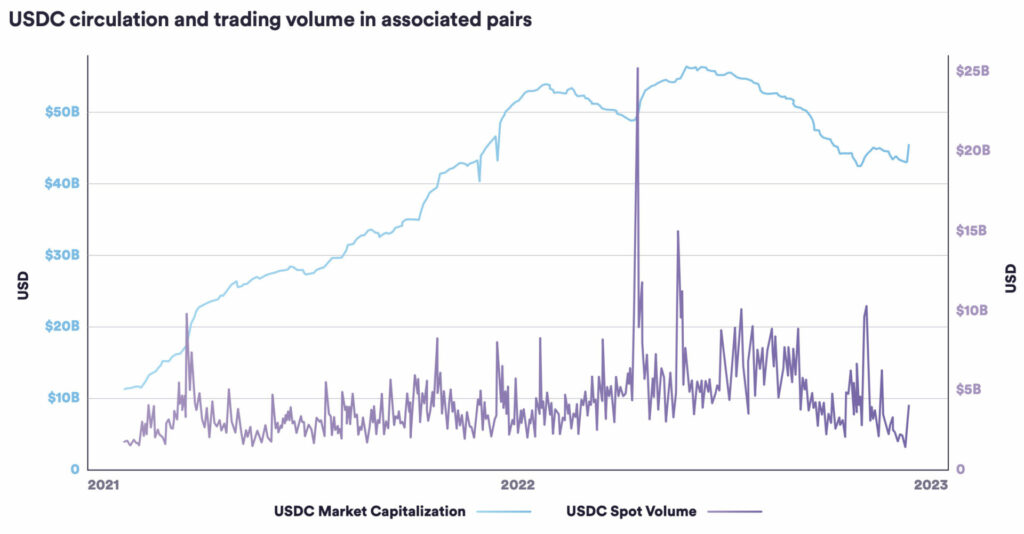

One of the leading stablecoins, USD Coin (USDC) is a regulated, fully reserved dollar digital currency with price parity to the U.S. dollar. Launched in 2018 by Circle, USDC has become one of the key drivers of growth in cross-border payments, with a circulation of $50 billion and $6.1 trillion transacted to date.

In just a few years, USDC has proven that it is possible to use digital assets for global settlements in full compliance with regulations, creating real-life use cases for borderless payments.

Cross-border remittances

At the time it went live in 1977, SWIFT was a revolutionary system, replacing the hitherto-standard of teleprinter networks known as Telex. Yet in today’s increasingly fast-paced world, SWIFT has proven to be woefully slow in making cross-border remittances—not to mention the exorbitant fees and potential losses due to FX exposure.

While the SWIFT system and correspondent banking networks have continued to falter when it comes to ensuring efficiency and reliability in transaction settlement, USDC provides an innovative and compliant means for low-cost, real-time, and borderless payments. In partnership with the Stellar Development Foundation, Circle enables more than a billion worth of USDC remittance volume for millions of customers worldwide.4

B2B cross-border payments

Where B2B payments have been plagued by much of the same issues as cross-border payments using legacy networks, USDC has proven to be a reliable means of global B2B settlements, as well. In addition to aforementioned advantages like low-cost and real-time payments, using USDC for B2B cross-border payments has the added bonus of helping businesses become more self-reliant. Businesses using USDC can track all their transactions in full transparency without needing an intermediary, as all of these transactions happen on-chain. As of December 2022, over $213 billion of USDC has been redeemed into USD from open-source and public blockchains.

Access to liquidity

USDC is also being used to provide liquidity for cross-border payments. Arf currently provides short-term USDC-based loans of 1 to 5 days for licensed money service businesses and financial institutions to send money to any country in real-time, with no additional collateral or prefunding required. Again, because all of these transactions happen on-chain, they can access an unprecedented level of transparency and traceability at every step, eliminating counter-party risk in cross-border settlements.

Access to financial services

Businesses and institutions facilitating cross-border payments usually have much less capital to be considered eligible as customers by traditional actors like banks. As a result, they can't benefit from even the most basic financial services such as custody and credit. By contrast, USDC enables wider access to better financial services for both businesses and individuals with increased cross-border payment volumes and remittance flows. To date, users in more than 191 countries5 can already access USDC via digital wallets—an unprecedented success rate in the expansion of a rather new currency, given that the stablecoin launched less than five years ago.

Transparency and stability are key.

In a relatively short amount of time, USDC has proven a reliable means of financial settlements in cross-border payments, with Circle’s unprecedented commitment to transparency.

Circle is regulated as a licensed money transmitter under U.S. state law. Circle’s financial statements are audited annually and subject to review by the Securities and Exchange Commission (SEC), and all SEC filings can be viewed on their website.

USDC is 100% backed by cash and short-dated U.S. treasuries, which makes it always redeemable 1:1 for USD. It is also attested by Grant Thornton, which is one of the largest tax, audit, and advisory firms in the U.S.

Circle reports on all attestation reports and weekly USDC reserves breakdown publicly on their website, showing that the asset remains fully compliant with regulations.

Given Circle’s partnerships with leading fintech players and USDC’s status as arguably the most reliable stablecoin, it’s certain that we’ll continue to see a growing list of use cases in cross-border payments.

1 https://www.statista.com/statistics/609723/value-of-cross-border-payments-by-type/

2 https://coinmarketcap.com/view/stablecoin/

3 https://thedefiant.io/stablecoin-volume-hits-record-high-of-7-4t-in-2022

4 https://6778953.fs1.hubspotusercontentna1.net/hubfs/6778953/USDC%20Uses%20Fact%20Sheet%20(1).pdf

5 https://techwireasia.com/2022/11/circle-lands-in-apac-how-are-they-winning-the-stablecoin-war-with-usdc/