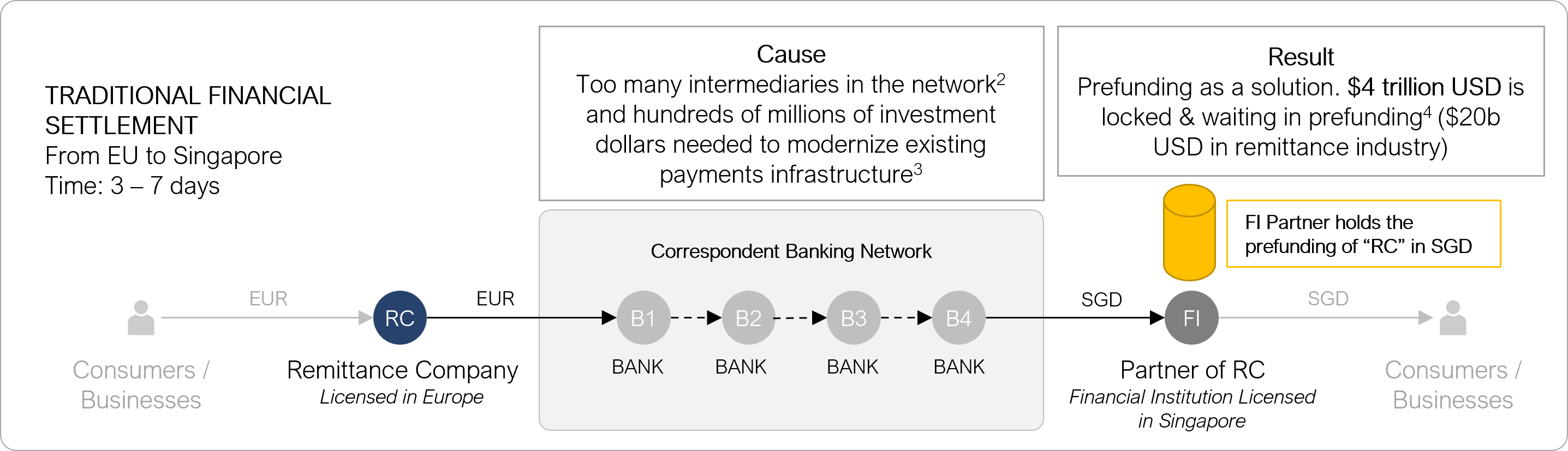

Cross-border money transfers usually flow through a correspondent banking network that consists of chains of banks, cooperatively working to transfer funds from the payer to the payee. However, this model is problematic, as it adds extra time and cost to money transfers, and demands a lot of operational effort on the banks’ side.

Since real-time, instant cross-border payments are still not achieved, the current system quick-fixes the problem by ‘prefunding’.

Let’s say there is Bank A in Germany, a respondent bank, and Bank B in Singapore, which is Bank A’s correspondent partner. In the correspondent banking model, Bank B holds deposits owned by Bank A. When Bank A wants to transfer money to Singapore on that day, Bank B pays out from the deposits of Bank A, before the settlement is met. ‘Pre’ in the prefunding stands for ‘before’ the actual settlement takes place, which will happen in 3-4 days later due to the shortcomings of the current system. In other words, prefunding is basically keeping balances in relevant accounts in different countries to shorten the time circuit needed for a cross-border payment.

In prefunding, each participant deposits cash to the expected value of its maximum net obligations for the next settlement cycle, eliminating the settlement risk in the payment system.[1] In case a participant fails, they have already provided the funds to cover their liabilities.[2] It also provides intraday liquidity management, which is essential for the payment system to run easily and without failure.

To put it simply, prefunding operates as a ‘patch’ to overcome the shortcomings of the correspondent banking model. And as all patches in financial models, it comes with trade-offs:

- Tied capital: Especially when there are long settlement cycles, prefunded capital acts as a barrier to entry for most new players in the industry, such as challenger banks and non-bank payment service providers (PSPs), that have limited cash to use for prefunding.[3]

- Opportunity cost: It causes an increase in both financial and opportunity costs, due to the exposure to FX conversion rates, liquidity costs, and the tied capital that could be used for another business opportunity.

- Operational inefficiency: A massive business development effort along with the investment of people, time, and money are required to find trusted partners who will not take your money and run away with it.

- Additional risks: While prefunding plays a critical role in minimizing risks associated with payment delays and failures, it can create new credit risks in the financial system, for example, if commercial banks offer loans to support the prefunding in a foreign currency.[4]

These challenges need to be addressed as soon as possible to enhance cross-border payments.[5] It is almost 2022, and cross-border payments are still lagging behind domestic ones in terms of time, cost, and transparency. To achieve instant cross-border payments, the global financial system needs more than just a workaround.

[1] https://www.finextra.com/blogposting/11586/how-can-we-handle-settlement-for-cross-border-immediate-payments

[2] https://www.bankofengland.co.uk/-/media/boe/files/payments/boesettlementaccounts.pdf

[3] https://www.finextra.com/blogposting/11586/how-can-we-handle-settlement-for-cross-border-immediate-payments

[4] https://www.bis.org/publ/qtrpdf/r_qt2003h.htm